Card currency payments when traveling can be a lifesaver, but navigating exchange rates, fees, and security concerns is crucial. This guide breaks down the ins and outs of using credit and debit cards internationally, from understanding different payment systems to minimizing costs and maximizing security. We’ll explore the advantages and disadvantages, delve into regional variations, and offer practical tips to ensure smooth transactions while abroad.

From choosing the right card to understanding transaction fees and fraud prevention, we’ll equip you with the knowledge to confidently handle your finances while traveling. Learn about alternative payment methods, and discover how to avoid costly pitfalls when making payments in foreign currencies.

Introduction to Card Currency Payments Abroad

Using credit and debit cards for transactions while traveling internationally has become increasingly common and convenient. This method offers a straightforward way to manage expenses in foreign currencies, often simplifying the process of exchanging money and reducing the need for physical cash. This approach is particularly useful in unfamiliar locations where navigating local payment systems can be challenging.

Different Card Payment Systems

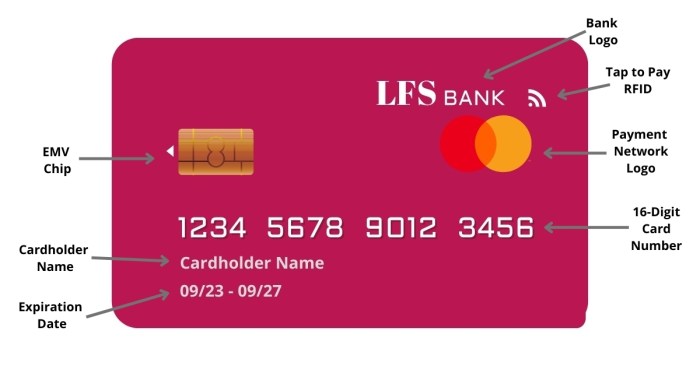

Various card payment networks, like Visa, Mastercard, and American Express, operate globally. Additionally, some countries have their own regional card payment networks. These networks facilitate transactions by processing information securely and reliably between the cardholder, the merchant, and the financial institution. The specific network used depends on the card issuer and the merchant’s acceptance of various networks.

Benefits of Using Cards for Currency Exchange

Using cards for currency exchange offers several advantages. Firstly, it eliminates the need for exchanging currency at potentially less favorable exchange rates offered by local bureaus or exchange services. Secondly, the convenience of using a familiar payment method can streamline the transaction process, especially in unfamiliar environments. Lastly, the security measures employed by most major card networks can minimize the risk of fraud or theft.

Methods of Making Payments Abroad

Cards can be used in various ways when traveling abroad. In-store transactions are common, where the card is simply presented to the cashier for payment. Online purchases can also be made using cards, providing flexibility for booking accommodations, purchasing souvenirs, or ordering food. Furthermore, many ATMs internationally allow for withdrawals using cards, enabling travelers to access cash as needed.

Comparison of Card Payment Advantages and Disadvantages

| Feature | Advantages | Disadvantages |

|---|---|---|

| Security | Secure encryption protocols and fraud detection systems protect against unauthorized transactions. Many cards offer comprehensive fraud protection. | Card skimming or other fraudulent activities are still possible, although less frequent than other methods. Security depends on the cardholder’s adherence to safe practices. |

| Transaction Fees | Most transactions using cards have minimal transaction fees, although some merchants may add additional charges. | Some international transactions may involve foreign transaction fees or interchange fees added by the card issuer. This can be a significant expense for frequent travelers. |

| Exchange Rates | Card networks typically provide an exchange rate that is often comparable to, or slightly better than, what a traveler might get at a bureau de change. This can save money compared to other methods. | Exchange rates are not always the most favorable compared to other methods, and can fluctuate based on market conditions. Additional fees may be applied to the transaction, affecting the final cost. |

Exchange Rates and Fees

Understanding exchange rates and associated fees is crucial for managing your spending when using cards abroad. These factors can significantly impact the overall cost of your trip, and knowing how to navigate them empowers you to make informed decisions. A thorough grasp of these nuances ensures you get the most value from your card while traveling.Exchange rates for card transactions abroad are influenced by several key factors.

These include the prevailing exchange rate between your home currency and the foreign currency, market conditions, and the specific policies of the card provider. Fluctuations in global markets, economic news, and geopolitical events can all impact the exchange rate at any given moment. Additionally, your bank or card provider might apply their own markup or commission, further influencing the final exchange rate you experience.

Planning card currency payments while traveling can be tricky, especially when unexpected events arise. For example, Disney World recently announced reduced opening hours, disney world reduced opening hours , which might impact your budgeting for dining and shopping. Thankfully, many US-based card providers offer excellent exchange rates, making international transactions more manageable, even with adjusted park schedules.

Factors Influencing Exchange Rates

Exchange rates are dynamic and are constantly shifting based on a variety of market conditions. The relative strength of the currencies involved plays a major role. A strong US dollar, for example, will translate to fewer foreign currency units when converted. Similarly, economic indicators such as interest rates and inflation in both countries impact the exchange rate.

The supply and demand for each currency in the international market also have a direct effect.

Common Fees Associated with Card Payments Abroad

Several fees can impact the cost of using your card abroad. Transaction fees are charges levied by the card network (e.g., Visa, Mastercard) for processing the transaction. Foreign transaction fees are often imposed by your bank or card provider as an additional charge on top of the transaction fee. These fees can vary significantly depending on the specific card and bank.

Table of Fees and Implications

| Fee Type | Description | Implications for Travelers |

|---|---|---|

| Transaction Fee | A charge levied by the card network for processing the international transaction. | Adds to the overall cost of the purchase. |

| Foreign Transaction Fee | A charge imposed by the issuing bank or card provider for processing an international transaction. | Increases the effective exchange rate and overall cost of the purchase. |

| Cash Advance Fee | A fee charged if you withdraw cash from an ATM using your card abroad. | Significantly increases the cost of withdrawing cash compared to using your card for purchases. |

Comparison of Exchange Rates by Bank/Card Provider

Different banks and card providers have varying policies regarding exchange rates and fees. Some providers might offer more favorable exchange rates than others, potentially resulting in significant cost savings for travelers. Researching and comparing rates and fees across different providers is crucial to identify the best option for your travel plans. For instance, a traveler might find that a specific credit card provides a more competitive exchange rate for international transactions, resulting in substantial savings compared to their primary bank account.

Minimizing Exchange Rate and Transaction Fees

Several strategies can help you minimize these fees. Using a card with no foreign transaction fees can significantly reduce costs. Taking advantage of a travel-specific credit card or checking account that has reduced or no foreign transaction fees is another effective approach. Additionally, checking for promotional offers or discounts on international transactions from your card provider can further minimize expenses.

Knowing these strategies empowers travelers to make smart financial choices when using cards abroad.

Security and Fraud Prevention

Traveling with your credit or debit card abroad can be exciting, but it’s crucial to prioritize security to avoid unwanted financial issues. Understanding the security measures in place and common fraud tactics will help you make informed decisions and protect your hard-earned money. Knowing how to report lost or stolen cards quickly is also vital.Protecting your financial information when using your cards in foreign countries requires a proactive approach.

Implementing basic security measures and recognizing potential fraud attempts can significantly reduce the risk of financial loss. This section provides practical steps to safeguard your transactions and maintain peace of mind while traveling.

Security Measures by Card Networks

Card networks like Visa and Mastercard employ various security measures to protect travelers. These measures include advanced encryption technologies, fraud detection systems, and real-time monitoring. These systems analyze transactions for suspicious patterns, helping to identify and prevent fraudulent activities before they impact you. Regular updates and improvements to these systems are a key part of their commitment to secure transactions.

Common Fraud Schemes Targeting Travelers

Several fraud schemes specifically target travelers using their cards abroad. Skimming is a common method, where criminals use devices to steal card information. Phishing scams, which involve fraudulent emails or websites designed to trick you into revealing your card details, are also prevalent. Look-alike ATMs and compromised POS terminals are other ways fraudsters may try to gain access to your card information.

Also, be aware of fraudulent websites that look like legitimate online stores or booking sites.

Precautions to Avoid Fraud

Taking proactive steps can significantly reduce your risk of becoming a victim of fraud. Avoid using public Wi-Fi networks for sensitive transactions. Be wary of suspicious ATMs or POS terminals that look unusual or have any signs of tampering. Always check for the security seals on ATMs and POS terminals. Look for reputable and secure websites for online transactions.

If in doubt, contact your bank or card issuer immediately. Keep a close eye on your statements for any unauthorized charges or activities. Report suspicious emails or websites to the appropriate authorities.

Reporting Lost or Stolen Cards

If your card is lost or stolen while traveling, report it immediately to your bank or card issuer. Provide them with your current location and any relevant details. This prompt action helps to limit the potential for fraudulent use of your card. Blocking the card and obtaining a replacement card are typically part of the process. You should also contact your bank or card issuer in the event of any suspicion of fraud or unauthorized activity.

Securing Card Transactions Abroad

Using ATMs and POS terminals securely involves a multi-layered approach. When using an ATM, choose a well-lit and populated location. Avoid ATMs that appear unusual or have any signs of tampering. Enter your PIN quickly and discreetly, covering it with your hand or using a physical cover if available. When using POS terminals, be vigilant about your surroundings and ensure the terminal looks legitimate.

Check the merchant’s identification and confirm the transaction details before you finalize the purchase. Do not disclose your PIN to anyone.

Using ATMs Securely

- Select a well-lit and populated location.

- Inspect the ATM for any signs of tampering.

- Enter your PIN quickly and discreetly.

- Do not disclose your PIN to anyone.

Using ATMs in unfamiliar environments requires vigilance to avoid scams. Taking these precautions can significantly reduce the risks associated with using ATMs in foreign countries.

Using POS Terminals Securely

- Check the merchant’s identification.

- Confirm the transaction details.

- Be aware of your surroundings.

- Avoid using compromised or suspicious terminals.

POS terminals are used for various transactions, from shopping to dining. Implementing these security measures helps travelers protect themselves from fraud attempts when using POS terminals while abroad.

Alternatives and Considerations

While card payments are increasingly popular for international travel, understanding alternative methods and their nuances is crucial. Different options cater to various needs and preferences, from the convenience of a tap-and-go transaction to the security of a physical check. This section explores these alternatives, their pros and cons, and how to make informed choices for your travels.Exploring alternative payment methods, beyond credit and debit cards, can offer valuable advantages and flexibility when traveling internationally.

Weighing the factors of cost, convenience, and security is essential to selecting the most suitable option for your trip. This analysis will delve into traveler’s checks, prepaid cards, and other methods, comparing them to card payments to provide a comprehensive overview.

Traveler’s Checks

Traveler’s checks offer a tangible, secure way to carry funds abroad. They are typically issued by financial institutions and are often backed by a guarantee, reducing the risk of loss or theft compared to cash. However, they come with a fee structure and might not be as readily accepted everywhere as cards. Some countries may also have specific regulations or restrictions regarding traveler’s checks.

Prepaid Cards

Prepaid cards offer a convenient alternative to traditional credit cards. You load funds onto the card, and these funds are used for purchases. This avoids the potential for overspending and can provide a sense of control over your spending abroad. However, you must manage the funds on the card effectively and ensure that sufficient funds are available.

Figuring out card payments when traveling can be tricky, but it’s a small price to pay for a fantastic trip! Once you’ve got your payment sorted, you can focus on exploring the local nightlife. Checking out the vibrant scene, trying out local cuisine, or just people-watching can be a rewarding experience, especially after a long day of sightseeing.

There are so many exciting things to do at night, like enjoying live music, exploring hidden bars, or simply relaxing in a cozy cafe. things to do at night. Ultimately, planning your payment options beforehand helps you enjoy the local culture and nightlife with peace of mind. Knowing your payment options is key for a worry-free trip!

Prepaid cards often have international transaction fees, which vary based on the issuer and the destination.

Comparing Card Payments to Alternatives

| Feature | Card Payments | Traveler’s Checks | Prepaid Cards |

|---|---|---|---|

| Cost | Typically lower fees, especially with no foreign transaction fees. | Fees for purchase and sometimes for cashing out. | Transaction fees often apply, especially for international transactions. |

| Convenience | High convenience with widespread acceptance and ease of use. | Convenience varies; acceptance can be limited in some areas. | Convenience depends on the specific card; usually easy to use once loaded. |

| Security | High security with built-in fraud protection and transaction monitoring. | High security due to physical nature and bank backing. | Security depends on the card provider; some offer transaction monitoring. |

Checking with Banks/Card Providers

It’s critical to contact your bank or card providerbefore* your trip to understand any potential fees or restrictions related to international transactions. This proactive step ensures a smooth and problem-free travel experience. For example, some banks might charge a foreign transaction fee, or your card might have limitations on international usage.

Figuring out card currency payments when traveling can be tricky, especially when you’re booking a cruise. With the recent expansion of Holland America Line’s standby travel options, holland america standby travel expansion , it’s even more important to check the payment policies. Ultimately, understanding your payment options and any potential fees is key before you finalize your trip.

Best Card Types for International Travel

Choosing the right card type is essential for maximizing rewards and benefits. Consider cards with no foreign transaction fees, robust fraud protection, and comprehensive travel insurance. Rewards programs can also significantly enhance your trip by providing potential discounts or points for purchases.

Optimizing Card Use for Maximum Value and Safety

- Monitor your statements closely: Regularly reviewing your transactions is crucial to detect any unauthorized charges or discrepancies promptly.

- Enable real-time transaction alerts: This allows you to be informed immediately of every transaction, enhancing your vigilance against fraud.

- Inform your bank of your travel plans: Providing this crucial information to your bank/card provider helps them proactively identify and avoid any potential issues.

- Use a separate card for travel expenses: This allows you to monitor and control your spending more efficiently.

- Carry a backup form of payment: Having a backup method, such as traveler’s checks or a prepaid card, offers a safety net in case your primary card is lost or unavailable.

Regional Variations and Local Practices

Navigating the world of international card payments involves understanding the nuanced differences in acceptance and usage across various regions. Local customs, technological infrastructure, and economic factors all play a role in how widely accepted and utilized card payments are. This section delves into the regional variations, highlighting the diversity in payment systems and preferences.Understanding these variations is crucial for a smooth travel experience, allowing travelers to anticipate potential challenges and prepare accordingly.

This knowledge ensures travelers are not caught off guard by unexpected payment limitations and can make informed decisions about carrying sufficient local currency or alternative payment methods.

Card Payment Acceptance Across Regions

Card acceptance varies significantly depending on the region. While major credit and debit cards are widely accepted in developed countries, their usage might be less prevalent in some developing nations or specific regions within a country. This can be attributed to factors such as the availability of ATMs, the prevalence of mobile payment systems, and the overall level of financial inclusion in the region.

Regional Variations in Payment Systems

Different regions have varying payment systems, which can impact card payment usage. For example, in some parts of Asia, mobile payment systems like Alipay and WeChat Pay are exceptionally popular, while in Europe, contactless payments are common. This difference in prevalent payment methods influences the availability and frequency of card transactions.

Local Customs and Card Usage

Local customs and expectations also affect card payment practices. In some cultures, direct cash transactions are preferred for certain goods or services, while in others, card payments are expected and readily accepted. Understanding these social norms can be helpful in ensuring a seamless and respectful payment experience.

Examples of Regional Variations

Consider the following examples: In parts of Southeast Asia, the popularity of mobile wallets like GrabPay or Gojek is exceptionally high. In contrast, in some African countries, cash remains the dominant payment method for everyday transactions, although card usage is increasing in urban areas.

Common Payment Methods and Acceptance Rates

This section presents an overview of common payment methods in various countries and their acceptance rates. It is important to note that these figures are estimations and may vary based on the specific region or merchant.

- Latin America: While credit cards are becoming more common, cash remains the dominant payment method in many regions, particularly for smaller transactions. Debit cards are also widely accepted in urban areas.

- Southeast Asia: Mobile payment systems like Alipay and WeChat Pay are highly prevalent. Credit and debit cards are accepted, but the extent of acceptance varies by country and merchant.

- Africa: Cash is the most prevalent method, particularly in rural areas. However, card usage is growing in urban centers and tourist areas.

- Europe: Credit and debit cards are very widely accepted, with contactless payments being particularly popular. Cash is still used, but its prevalence is declining in many regions.

Summary Table of Card Acceptance Rates and Preferences

The following table summarizes the card acceptance rates and payment preferences for different countries/regions, providing a general overview. The acceptance rate is a subjective measure, and the data is not exhaustive, but it gives a general idea of the payment landscape.

| Region | Card Acceptance Rate (General Estimate) | Payment Preferences |

|---|---|---|

| North America | Very High | Credit/Debit Cards, Mobile Payments |

| Western Europe | Very High | Credit/Debit Cards, Contactless Payments, Mobile Payments |

| Eastern Europe | High | Credit/Debit Cards, Cash |

| Southeast Asia | Moderate | Mobile Payments, Credit/Debit Cards, Cash |

| Latin America | Moderate | Cash, Credit/Debit Cards, Mobile Payments (growing) |

| Africa | Low-Moderate (increasing) | Cash, Credit/Debit Cards (mostly urban areas) |

Troubleshooting and Support

Navigating international transactions can sometimes lead to unexpected hiccups. Understanding potential problems and how to address them proactively can significantly ease your travel experience. This section provides a comprehensive guide to resolving issues that might arise when using your cards abroad.Troubleshooting payment issues abroad requires a systematic approach. Knowing the steps to take when problems occur, including contacting support, can minimize frustration and ensure a smooth payment process.

Thorough preparation beforehand can greatly reduce the stress of dealing with unforeseen circumstances.

Common Payment Issues

Many issues arise due to differing payment systems, local regulations, or technical glitches. Some common problems include declined transactions, incorrect currency conversions, or unauthorized charges. Misunderstandings regarding fees or transaction limits can also lead to difficulties.

Resolving Payment Issues While Traveling

When a payment issue arises, immediate action is crucial. First, carefully review the transaction details, including the amount, date, and merchant information. This detailed record is essential for reporting the issue to your card issuer. Documenting any communications with the merchant is also helpful.

Contacting Customer Support

Knowing how to contact your card issuer’s customer support is vital. Utilize multiple contact methods like phone, email, or online chat. Support channels often vary by card network and bank.

Card Network and Bank Support Contacts, Card currency payments when traveling

Accessing support can be easier with direct contact information. Below is a table providing contact information for different card networks. This allows for quick access to assistance when needed.

| Card Network | Phone Support | Email Support | Website/Online Chat |

|---|---|---|---|

| Visa | +1-800-VISA-4242 | visa.com/contact | visa.com/support |

| MasterCard | +1-800-MASTER-CARD | mastercard.com/contact | mastercard.com/support |

| American Express | +1-800-THE-CARD | americanexpress.com/contact | americanexpress.com/support |

| Discover | +1-800-DISCOVER | discovercard.com/contact | discovercard.com/support |

Note: Contact information may vary by region. Always verify the specific support numbers for your location. Be prepared to provide your card number and transaction details.

Steps for Contacting Support

Clearly explain the issue to the support representative, providing as much detail as possible. Record the representative’s name and case number for future reference. Keep copies of any correspondence related to the issue.

Last Word: Card Currency Payments When Traveling

In conclusion, card currency payments when traveling offer convenience and flexibility, but understanding the nuances of exchange rates, fees, and security measures is key. By researching your options, comparing rates, and taking necessary precautions, you can leverage the power of cards for seamless and secure international transactions. Remember to prioritize safety, be mindful of local regulations, and always check with your bank before embarking on your journey.

This guide has hopefully equipped you with the essential knowledge to make informed decisions about card payments abroad.