Volatile weakening usd how travelers can plan trip smartly – Volatile weakening USD: how travelers can plan trip smartly. A weakening US dollar can significantly impact your travel budget. Understanding how currency fluctuations work, and how to strategize your spending, is key to navigating these shifts and ensuring a smooth and cost-effective trip. This guide dives into various aspects, from monitoring exchange rates to finding affordable accommodation and transportation, providing you with practical tools and strategies to maximize your travel experience while minimizing financial risks.

This article will walk you through different methods to manage your travel budget in a volatile currency environment. We’ll look at various strategies for budgeting, exchange options, and smart planning tips to ensure your trip aligns with your financial goals, even with a fluctuating USD. From optimizing your travel bookings to choosing the best exchange methods, we’ll cover it all to help you plan a successful and budget-friendly adventure.

Understanding USD Volatility

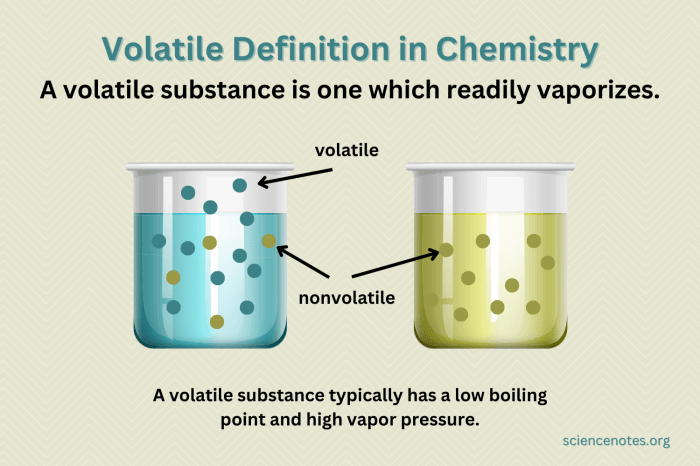

The US dollar (USD) is the world’s reserve currency, meaning it’s widely used in international transactions. This global role makes it susceptible to fluctuations, impacting travel costs significantly. Understanding these fluctuations is crucial for savvy travelers planning international trips.Currency exchange rates are dynamic, constantly changing based on various economic factors. A weakening USD means that your dollars buy fewer units of foreign currency, increasing the cost of goods and services in those countries.

With the USD weakening, savvy travelers need to plan trips strategically. Adjusting budgets and researching deals is key. And for those experiencing loss, like a young widow seeking solace and support, group travel for grief, such as the young widow group travel for grief options, can offer a unique opportunity for healing. Ultimately, with a little foresight, everyone can navigate these currency fluctuations and plan amazing trips, regardless of circumstances.

Conversely, a strengthening USD makes your dollars stretch further, potentially saving you money on your travels.

Impact on Travel Costs

Currency fluctuations directly affect the cost of flights, accommodation, food, and activities when traveling internationally. A weakening USD means your spending will translate into a higher amount of foreign currency, leading to more expensive travel experiences.

Factors Influencing USD Weakness

Several factors contribute to the USD’s weakening against other currencies. These include:

- Interest rate differentials: If interest rates in other countries are higher than in the US, investors may shift their funds to those countries, increasing demand for their currencies and decreasing demand for the USD.

- Economic performance: A perceived weakening in the US economy, compared to other countries, can decrease investor confidence in the USD, leading to its depreciation.

- Global events: Major global events, like political instability or economic crises, can cause significant fluctuations in exchange rates, often impacting the USD negatively.

- Inflationary pressures: High inflation in the US can erode the purchasing power of the USD, potentially leading to its weakening against other currencies.

Correlation with International Travel Expenses

The value of the USD directly correlates with international travel expenses. A strong USD makes international travel cheaper, while a weak USD makes it more expensive. For example, if the USD weakens against the Euro, a European vacation will cost more in US dollars. This is because you’ll need more US dollars to buy the same amount of Euros.

Monitoring Currency Exchange Rates

Staying informed about currency exchange rates is essential for effective travel planning. Several methods exist for monitoring these rates:

- Online currency converters: Numerous websites offer real-time currency conversion tools. These tools are valuable for quick comparisons and projections.

- Financial news websites: Major financial news outlets often provide detailed analysis and forecasts of currency exchange rates. These analyses offer deeper insights into the factors influencing exchange rates.

- Dedicated currency tracking apps: Mobile apps can track currency fluctuations in real-time, providing notifications of significant changes.

USD Value Against Key Travel Destinations (Past Year)

This table provides a snapshot of the USD’s value against key travel destinations over the past year. This data can be used to illustrate the volatility in the currency exchange market. Note that these are

example* figures, and actual values may vary depending on the specific date and time of the exchange.

| Destination | Currency | Average USD Value (Year-to-Date) |

|---|---|---|

| Eurozone (EUR) | Euro | $1 USD = 0.90 EUR (Approximate) |

| United Kingdom (GBP) | Pound Sterling | $1 USD = 0.75 GBP (Approximate) |

| Japan (JPY) | Yen | $1 USD = 140 JPY (Approximate) |

| Canada (CAD) | Canadian Dollar | $1 USD = 1.30 CAD (Approximate) |

| Mexico (MXN) | Mexican Peso | $1 USD = 18 MXN (Approximate) |

Planning Strategies for Travelers

Navigating a volatile USD can significantly impact travel plans. Understanding the potential fluctuations in exchange rates is crucial for savvy travelers to minimize financial risks and optimize their spending. This section details strategic approaches to manage these risks and maximize your travel experience.A fluctuating USD necessitates a proactive approach to travel budgeting. Rather than simply relying on a fixed budget, travelers should consider flexible budgeting strategies that accommodate currency shifts.

By understanding and adapting to these changes, travelers can safeguard their planned expenditure and potentially enjoy better value for their money.

Optimizing Travel Budgets During Currency Fluctuations

Predicting currency movements is challenging. However, proactively adjusting your budget based on current exchange rates is a valuable strategy. This involves monitoring currency conversion rates, especially when booking flights, accommodation, and tours. Flexibility is key to adapting to changes. Adjusting budgets can be achieved by monitoring currency fluctuations.

Consider setting a range for expenses, rather than a fixed amount. For instance, if you anticipate a weaker USD, allocate a larger portion of your budget to areas where currency exchange is significant.

Travel Booking Strategies in a Volatile USD Environment

Booking strategies play a crucial role in managing potential financial risks. Booking in advance, especially for flights and accommodations, can lock in a price, potentially shielding you from a significant devaluation in the USD. Last-minute deals can offer attractive opportunities for cost savings, but this approach carries the risk of encountering currency fluctuations that might negate the benefits. When comparing the two strategies, consider the current USD strength and the anticipated direction of currency exchange rates.

If the USD is expected to weaken, booking in advance might be a safer bet.

Travel Credit Cards and Foreign Transaction Fees

Travel credit cards with foreign transaction fees can present a challenge. While they offer benefits like travel rewards, their fees can eat into your savings, especially when dealing with a weak USD. Understanding the specific terms and conditions of your card is essential. Compare different cards based on their foreign transaction fee policies. Consider whether the benefits outweigh the costs.

Prioritize cards with lower or no foreign transaction fees, and be aware of the specific exchange rates applied by the card issuer.

Different Travel Budgeting Methods and Currency Changes

Different budgeting methods react differently to currency fluctuations. A fixed budget, while offering a clear financial framework, may prove inflexible during periods of substantial currency volatility. A flexible budget, which accounts for potential currency fluctuations, is a more adaptable approach. A flexible budget allows for adjustments in spending based on the actual exchange rates encountered during travel.

| Budgeting Method | Description | Response to Currency Changes |

|---|---|---|

| Fixed Budget | A predetermined budget amount for the entire trip. | Inflexible; can lead to significant overspending or underspending if currency changes drastically. |

| Flexible Budget | A budget with a range of spending allowances for each category. | Adaptable; allows for adjustments based on currency fluctuations. |

Flexible budgeting, in the context of volatile currency exchange rates, allows for greater adaptability and minimizes the risk of significant financial setbacks.

Currency Exchange Options

Navigating the fluctuating foreign exchange market can be tricky, especially when the USD is weakening. Choosing the right currency exchange method can significantly impact your travel budget. Understanding the various options available and their associated costs is crucial for maximizing your savings and ensuring a smooth trip.Different exchange methods offer varying degrees of control over exchange rates and fees.

This section explores the key options, highlighting their pros and cons, and demonstrating how to calculate potential savings and costs.

Bank Exchange

Banks often offer currency exchange services, but their exchange rates are typically less favorable than those offered by specialized providers. This is often due to the bank’s overhead and profit margins. A significant advantage is the convenience of often having this service available in a familiar setting, such as your local branch.

Exchange Bureaus

Exchange bureaus are dedicated businesses specializing in currency exchange. They often have more competitive exchange rates than banks, particularly for larger transactions. They are readily available in tourist areas, but may not be the best option for individuals needing a smaller amount of currency. Their exchange rates can vary depending on location and demand.

With the volatile weakening USD, savvy travelers need to plan trips strategically. One smart move is to look into destinations offering excellent value. For example, consider Salem, Massachusetts, a captivating historical town brimming with fascinating attractions, like haunted houses and witch trials. Checking out top things to do in Salem, Massachusetts can help you maximize your budget.

By researching in advance and being flexible with dates, you can make the most of your trip, even with a fluctuating currency.

Online Currency Exchange Platforms

Online platforms have emerged as a popular alternative for currency exchange. These platforms often offer transparent exchange rates and low fees, especially for larger transactions. They offer the benefit of comparing rates from various providers without leaving your home. However, security and the legitimacy of the provider should be carefully evaluated. Fees for online transfers can also vary significantly.

Calculating Potential Savings

Comparing exchange rates from different providers is essential to understand potential savings. Let’s assume you need 10,000 Euros. If Bank A offers an exchange rate of 1 USD to 0.85 Euros, you’ll need approximately $11,765. If an online platform, like CurrencyFair, offers a rate of 1 USD to 0.88 Euros, you’ll only need approximately $11,364. The difference can be substantial over larger amounts.

Example: To determine the best exchange option, compare the exchange rate offered by each method. The rate with the highest Euro value per USD will give the best deal.

Costs Associated with Different Exchange Methods

Various costs are associated with each exchange method. Banks often charge fees and commissions, while exchange bureaus typically have fixed fees for their services. Online platforms usually have transparent fee structures, often charging a small percentage or a flat fee per transaction. These fees can significantly impact the final cost, especially for large amounts.

Comparing Currency Exchange Platforms

The following table provides a comparative overview of different currency exchange platforms. Keep in mind that exchange rates and fees can fluctuate.

| Platform | Exchange Rate (USD to EUR) | Fees | User Reviews |

|---|---|---|---|

| CurrencyFair | 1 USD = 0.88 EUR | Low percentage fee | Generally positive, highlighting transparency and ease of use |

| TransferWise | 1 USD = 0.87 EUR | Low percentage fee, often with options for free transfers | Highly rated for speed and reliability |

| XE.com | 1 USD = 0.86 EUR | Flat fee per transaction | Positive reviews, known for competitive rates |

Accommodation and Transportation: Volatile Weakening Usd How Travelers Can Plan Trip Smartly

Navigating the complexities of international travel during periods of fluctuating USD exchange rates requires strategic planning. Understanding how accommodation and transportation costs are affected by currency fluctuations is crucial for budget-conscious travelers. This section dives into practical strategies for finding affordable options and optimizing your travel experience during a weak USD.

Finding Affordable Accommodation Options

A key aspect of saving money while traveling is securing affordable accommodation. Researching beyond the typical hotel booking sites is essential. Consider alternative options like hostels, guesthouses, or Airbnb. These often offer more budget-friendly rates, particularly in popular tourist destinations where prices can spike during peak seasons. Furthermore, exploring off-the-beaten-path neighborhoods can yield significant savings without sacrificing comfort or convenience.

Finding Cost-Effective Transportation

Transportation costs can significantly impact your overall travel budget. Taking advantage of local transportation options, like buses or trains, can often be more economical than relying solely on taxis or ride-sharing services. Comparing prices for different transportation modes and researching the most efficient routes are vital steps in optimizing your budget. For example, a train journey might be significantly cheaper than multiple flight segments, even when factoring in travel time.

Strategies to Save on Accommodation and Transportation

Utilizing travel apps and websites that offer deals and discounts on accommodations and transportation can yield considerable savings. Booking accommodations in advance, especially during peak seasons, can often lead to lower prices. Also, consider traveling during the off-season to avoid inflated prices. Be flexible with your travel dates and destinations to capitalize on potential price drops. Utilizing loyalty programs for hotels and airlines can also lead to significant savings.

Comparing Prices for Accommodation and Transportation

Comparing prices across different countries and cities requires careful consideration of the current USD exchange rate. Using online tools and converters can provide real-time comparisons, helping you determine the most cost-effective options. Furthermore, it is important to consider the quality and amenities offered in each location to determine if the price difference is justifiable. For example, a basic hostel room in a city center might be cheaper than a luxury hotel outside of the main tourist areas, but the convenience of the former may justify the higher cost.

Accommodation Costs in Different Countries (USD Comparison)

This table illustrates approximate accommodation costs in different countries, calculated based on current USD exchange rates. Note that these are estimates and actual prices may vary depending on the specific location, season, and type of accommodation.

With the USD weakening, savvy travelers need to plan trips strategically. Factor in potential price fluctuations when budgeting, especially for destinations like San Francisco, CA, where accommodation and activities can be costly. Checking out resources like San Francisco CA travel can help you find the best deals and maximize your trip experience. This careful planning is crucial when currency exchange rates are volatile, ensuring your trip remains within budget and enjoyable despite the weakening USD.

| Country | Accommodation Type (Example) | Approximate Cost (USD) |

|---|---|---|

| Thailand | Hostel Dorm | $15-30 |

| Italy | Budget Hotel | $80-150 |

| Japan | Capsule Hotel | $50-80 |

| France | Boutique Hotel | $150-250 |

| Australia | Airbnb Apartment | $100-200 |

Budgeting and Expense Tracking

Planning a trip during periods of fluctuating exchange rates requires meticulous budgeting and expense tracking. Understanding your spending habits and potential currency shifts is crucial for maintaining a comfortable and stress-free travel experience. A well-defined budget, adaptable to currency changes, will allow you to make informed decisions and avoid unexpected financial challenges.A robust expense tracking system allows you to monitor your spending against your budget, helping you stay within your allocated funds.

This proactive approach minimizes surprises and ensures that you can adjust your plans if necessary, especially in the face of currency volatility.

Importance of Tracking Travel Expenses

Tracking travel expenses is essential for maintaining control over your finances during a trip, especially when dealing with currency fluctuations. By meticulously recording your spending, you can quickly identify areas where you might be overspending and make adjustments accordingly. This proactive approach allows you to stay on track with your budget, even as exchange rates shift. Furthermore, meticulous expense tracking provides valuable data for future travel planning, allowing you to refine your budgeting strategies for similar trips.

Methods for Budgeting Travel Expenses

Developing a detailed budget is the first step in managing your travel expenses effectively. Break down your anticipated expenses into categories such as accommodation, food, transportation, activities, and souvenirs. Allocate a specific amount to each category based on your estimated needs and preferences. Using a spreadsheet or budgeting app can significantly simplify this process.

Creating a Flexible Budget

A flexible budget is crucial for navigating currency fluctuations. Instead of rigid allocations, assign a range of potential expenses for each category. For example, instead of $100 for accommodation, set a range of $80-$120, accounting for possible variations. This allows for adjustments if costs rise or fall unexpectedly. Regularly reviewing and updating your budget is essential, considering any currency changes or unforeseen circumstances.

Using Budgeting Apps and Tools, Volatile weakening usd how travelers can plan trip smartly

Numerous budgeting apps and tools are designed for tracking expenses, particularly useful for international travel. These apps allow you to categorize your spending, track your remaining funds, and monitor your progress towards your budget goals. Many apps offer currency conversion tools, making it easier to visualize your expenses in your home currency. These tools can automate the process of tracking expenses, allowing you to focus on enjoying your trip.

Sample Budget Allocation Table

| Expense Category | Budget Allocation (USD) |

|---|---|

| Accommodation | $80 – $120 per night |

| Food | $50 – $70 per day |

| Activities | $30 – $50 per day |

| Transportation | $20 – $40 per day |

| Souvenirs | $50 – $100 |

| Contingency Fund | $100 – $150 |

Tips for Smart Travel Planning

Navigating a weakening USD during your travels requires proactive planning and strategic decision-making. This phase focuses on practical strategies to maximize your travel experience while minimizing unnecessary costs in a challenging currency environment. Understanding the nuances of international pricing, cultural considerations, and efficient expense management is crucial.A weakening USD often leads to higher costs for travelers, but savvy planning can significantly mitigate these impacts.

This section delves into actionable steps for travelers to make the most of their budgets and experiences while abroad.

Optimizing Spending and Avoiding Unnecessary Costs

Effective travel planning involves meticulous budgeting and identifying areas where expenses can be minimized. Researching and comparing prices for accommodations, transportation, and activities beforehand is crucial. Consider alternative transportation options like buses or trains instead of taxis or ride-sharing services to save money. Eating at local restaurants, rather than upscale establishments, often offers delicious and affordable meals.

Negotiating Prices for Services and Goods

Negotiation is a common practice in many cultures. Knowing how to politely and effectively negotiate prices for goods and services can save a considerable amount of money. Researching average prices for similar items or services in the destination beforehand provides a strong bargaining position. Building rapport with vendors and showing genuine interest in their products or services can improve negotiation outcomes.

Researching Local Customs and Cultural Norms

Cultural sensitivity is paramount during international travel. Understanding local customs and etiquette can prevent misunderstandings and improve interactions with locals. Researching common greetings, dining customs, and appropriate attire for specific locations helps to ensure smooth interactions. Knowing the local customs regarding tipping or gift-giving can also be beneficial.

Proactively Managing Travel Expenses

Pre-planning and monitoring expenses is vital during periods of currency fluctuation. Using travel apps or spreadsheets to track expenses in both local currency and USD can help maintain control over spending. Using credit cards with no foreign transaction fees can also minimize additional charges. Having a contingency fund for unexpected expenses can further safeguard your trip budget.

Strategies for Smart Travel Planning During Currency Fluctuations

“Proactive planning, research, and negotiation are key to maximizing your travel experience while minimizing costs during a weakening USD. Cultural sensitivity and expense management are essential to avoid unnecessary expenses.”

Final Conclusion

In conclusion, planning a trip during a weakening USD requires proactive measures and strategic thinking. By understanding currency fluctuations, optimizing your budget, and choosing the right exchange methods, you can minimize financial risks and maximize your travel experience. This guide provided a comprehensive overview of essential strategies, enabling you to navigate the complexities of a volatile currency market and enjoy a worry-free adventure.

Remember to track your expenses, be flexible with your budget, and utilize resources available to you. Happy travels!

Leave a Reply